AB1001 -PRACTICAL ACCOUNTING

Learn Practical Accounting the Right Way – Hands-On, Job-Ready, Global Standards

At Mercury EduTech, our Practical Accounting Course bridges the gap between academic theory and real-world application. Designed for students, fresh graduates, job seekers, and working professionals, this course helps you master day-to-day accounting tasks, compliance requirements, and financial reporting using both manual methods and modern accounting software.

Whether your goal is to become a professional accountant, support your family business, or prepare for international career opportunities, this course gives you the skills employers value most.

What You Will Learn ?

Module 1 – Fundamentals of Accounting

- Basics of Debit & Credit

- Accounting Principles & Standards (GAAP, IFRS, Ind-AS)

- Journal Entries, Ledgers & Trial Balance

Module 2 – Business Transactions

- Recording Purchases, Sales, Receipts & Payments

- Vendor & Customer Accounts

- Cash & Bank Reconciliation

Module 3 – Payroll & Compliance

- Salary Processing

- TDS, GST & Tax Compliance (India & International Overview)

- Statutory Returns & Filings

Module 4 – Financial Statements Preparation

- Profit & Loss Account

- Balance Sheet

- Cash Flow Statements

- MIS Reporting for Decision Making

Module 5 – Software-Based Accounting (Hands-On Training)

- TallyPrime / Tally ERP 9

- QuickBooks Online (QBOA)

- Xero

- Peachtree (Sage 50)

- Microsoft Excel Advanced for Accounting

Module 6 – International Practical Exposure

- Accounting under IFRS & GAAP

- Multi-currency Transactions

- Consolidation of Accounts

Who Should Join?

This course is ideal for:

- Commerce & Finance Students (B.Com, M.Com, MBA)

- Job Seekers looking for Accounts Executive / Accountant roles

- Entrepreneurs & Small Business Owners

- Professionals upgrading their accounting software skills

- Anyone preparing for careers in India or abroad

Key Features

✔ Practical

On-the-Job Training – Simulated real-world accounting tasks.

✔ Hands-On Software

Training – Learn with multiple ERP and accounting systems.

✔ Indian &

International Focus – Covers GST, TDS, and IFRS/GAAP practices.

✔ Flexible Learning

– Onsite classroom & e-Learning available.

✔ Certification

– Earn a recognized certificate from Mercury EduTech.

✔ Placement

Assistance – Resume workshops, interview training, and employer connections

Duration & Mode

- Course Duration: 2 to 3 Months (Fast Track available)

- Mode: Onsite (Nagercoil, India) + Remote Online Classes (Global Access)

- Schedule: Weekday / Weekend / Evening Batches

Certification

On successful completion, learners receive a “Certified Practical Accountant” credential from Mercury EduTech, recognized by employers and helpful in pursuing international certifications like ACCA, CPA, CMA, or CIMA.

Career Outcomes

After completing this course, you will be confident to work as:

- Accounts Executive / Accountant

- Bookkeeper (Domestic or International)

- Tax Assistant / Payroll Officer

- MIS & Finance Analyst (Entry Level)

- Entrepreneur managing accounts independently

Enroll Now

Take the first step towards a successful accounting career.

Mercury EduTech – Practical Accounting Training

Website: www.mercuryedutech.com

Email:

admissions@mercuryedutech.com

Phone:

+91-

6381560230, +91 4652-279 972

Practical Skills. Global Standards. Career Success.

Frequently asked questions

Here are some common questions about our company and services.

At Mercury Edutech Academy, our Practical Accounting Course is designed to transform theoretical learners into confident, job-ready professionals. Through real-world accounting exercises, live projects, and ERP software training, students gain hands-on exposure to the entire accounting cycle — from journal entries to final financial statements. Below are some of the most frequently asked questions to help you understand our training approach, curriculum, and career opportunities.

The Practical Accounting Course is a hands-on training program designed to bridge the gap between theoretical accounting knowledge and real-world business applications.

The course is ideal for commerce students, graduates, working professionals, entrepreneurs, and anyone aspiring to build a career in accounting, auditing, or finance.

To

develop practical accounting skills, familiarize students with accounting

software, and prepare them to handle complete business accounts independently.

Unlike

theory-based courses, this training focuses on real business transactions,

software usage, and industry-specific accounting practices.

The

course includes journal entries, ledger posting, trial balance, financial

statements, GST, TDS, payroll, reconciliation, and management reporting.

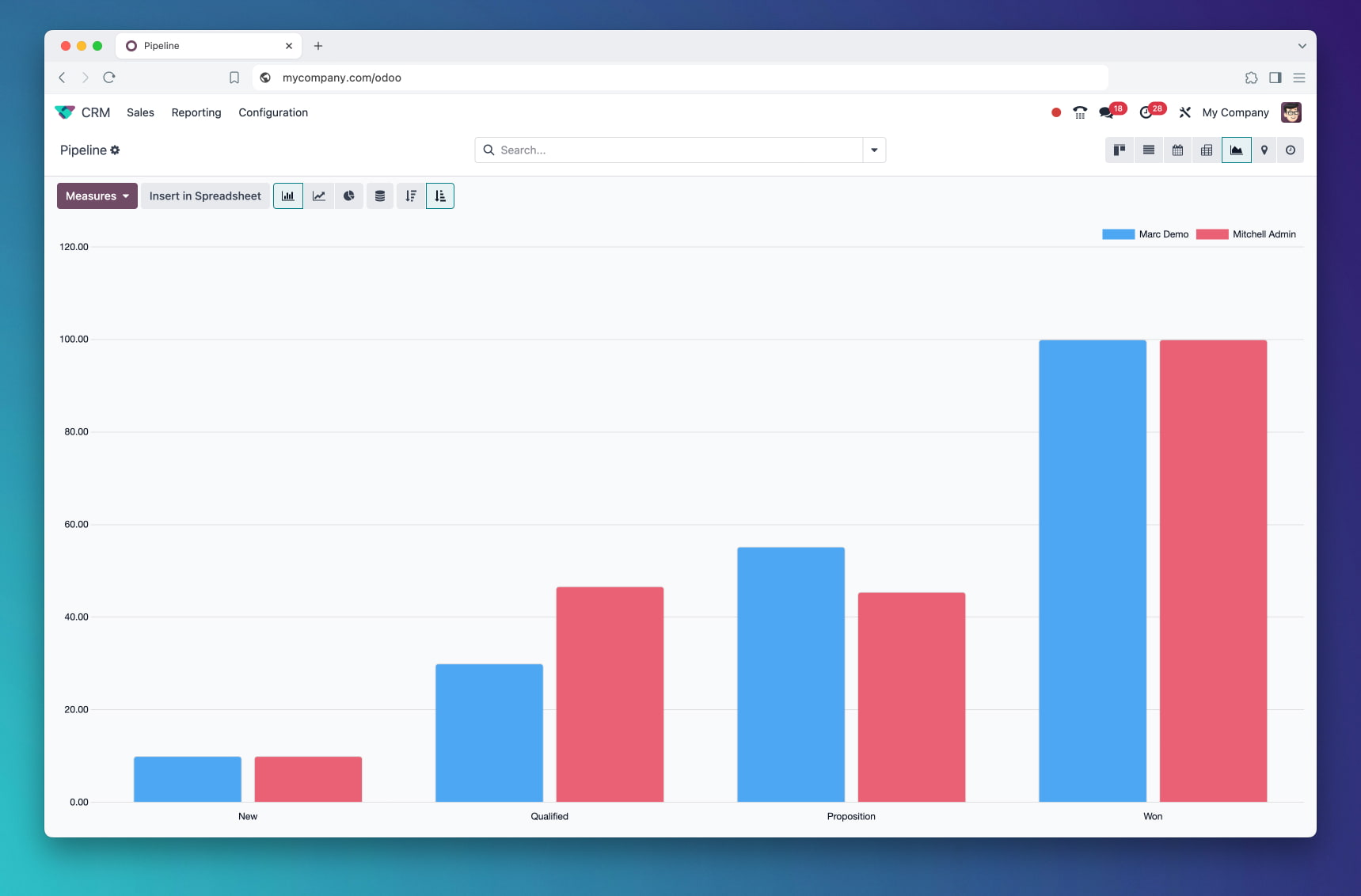

Yes.

Students receive hands-on training in popular accounting and ERP software

such as Tally Prime, Zoho Books, QuickBooks, Xero, Sage, SAP, and Odoo.

Absolutely.

The course starts from the basics and gradually advances to real-life

accounting scenarios and industry applications.

Yes.

Upon successful completion, students will receive a recognized Certificate

in Practical Accounting from Mercury Edutech Academy.

Yes.

Selected students can gain internship opportunities and exposure to live

business accounts through our partner companies.

The

Practical Accounting Course typically runs for 3 to 6 months, depending

on the chosen level and schedule.

Training

is available in classroom, online, and hybrid formats for

the convenience of local and international students.

Basic

understanding of commerce or mathematics is helpful, but anyone with a

passion for learning accounting can enroll.

Yes.

The course is designed to equip students with job-ready skills,

preparing them for roles such as Accountant, Accounts Executive, Bookkeeper, or

Finance Assistant.

Yes.

All trainers are experienced Chartered Accountants, Management Accountants,

and industry experts with global exposure.

Students

work on real transaction data, vouchers, and ledgers to simulate actual

accounting environments.

Training

includes examples and case studies from over 40 industries, including

manufacturing, trading, construction, retail, hospitality, and IT.

Yes.

All online sessions are recorded, and students receive lifetime access

to learning materials and updates.

Yes.

The course covers complete accounting cycles, including preparation of

Profit & Loss Accounts, Balance Sheets, and Cash Flow Statements.

Yes.

Students are trained in Indian and international taxation fundamentals,

including GST, VAT, TDS, and digital filing procedures.

Yes.

Periodic assignments and practical tests are conducted to evaluate

progress and strengthen understanding.

It

enables entrepreneurs to understand their own accounts, analyze

financial reports, and make informed business decisions.

Yes.

We assist students with resume preparation, mock interviews, and job

placement guidance through our industry network.

Yes.

The course is open to global learners, especially those seeking

international accounting exposure and software training.

Yes.

The course includes Advanced Excel for Accounting, covering formulas,

pivot tables, and MIS report automation.

Students

learn to prepare MIS reports, cash flow projections, bank reconciliations,

and management dashboards.

Yes.

Case studies are integrated to demonstrate practical accounting challenges

and problem-solving approaches.

Yes.

The syllabus is continuously updated based on the latest accounting

standards, software tools, and tax regulations.

Graduates

can work as Accountants, Bookkeepers, Tax Assistants, Finance Analysts,

or start their own accounting practice.

You

can register directly through our website or contact our admission team

via phone, WhatsApp, or email for personalized assistance.