PC3003 - CHARTERED ACCOUNTANCY FINAL(CA)

Chartered Accountancy (CA) – Final Course

The CA Final Course is the last and most advanced stage of the Chartered Accountancy journey. It prepares students for strategic leadership, global taxation, advanced auditing, corporate finance, and ERP-driven accounting systems. At Mercury Edutech Academy, we ensure that students master not only the ICAI syllabus but also practical applications through live projects, ERP training, taxation filing, and corporate case studies.

COURSE MODULES

GROUP I

Module 1: Financial Reporting

- Ind AS & IFRS – Advanced Applications

- Consolidation of Accounts (Holding & Subsidiary Companies)

- Accounting for Mergers, Demergers & Acquisitions

- Share-Based Payments & Financial Instruments

- Corporate Restructuring & Valuation Accounting

- Practical Training: Preparation of complex consolidated financials in SAP S/4 HANA, Oracle Fusion ERP, and MS Dynamics 365.

Module 2: Strategic Financial Management (SFM)

- Advanced Capital Budgeting & Risk Analysis

- Derivatives, Futures, Options & Swaps

- International Finance & Forex Management

- Portfolio Management & Mutual Funds

- Mergers, Acquisitions & Corporate Restructuring

- Practical Training: Financial modeling with Excel & Power BI, live forex simulations, and valuation cases.

Module 3: Advanced Auditing and Professional Ethics

- Risk Assessment & Audit Planning

- Audit of Consolidated Financial Statements

- Audit of Banks, Insurance & PSUs

- Investigation & Forensic Audit

- Professional Ethics & Liability of Auditors

- Practical Training: Mock audits with real company financials, ERP audit trail checks, and drafting professional audit reports.

Module 4: Corporate and Economic Laws

- Companies Act – Advanced Provisions

- SEBI Regulations, FEMA & Corporate Governance

- Insolvency & Bankruptcy Code (IBC)

- Economic Laws (Competition Act, PMLA, Benami Transactions Act)

- Practical Training: Drafting compliance reports, corporate legal opinions, and exposure to secretarial tools.

GROUP II

Module 5: Strategic Cost Management and Performance Evaluation (SCMPE)

- Cost Control & Reduction Techniques

- Transfer Pricing and Decision Making

- Balanced Scorecard & Performance Metrics

- Strategic Costing in MNCs & Service Industries

- Practical Training: Case studies with ERP costing modules, BI dashboards, and real-life company data.

Module 6: Electives (One Paper – Open Book Exam)

Students can choose one from:

- Risk Management

- Financial Services & Capital Markets

- International Taxation

- Economic Laws

- Global Financial Reporting Standards (GFRS)

- Multidisciplinary Case Studies

- Practical Training: Hands-on assignments, simulations, and case study discussions with mentors.

Module 7: Direct Tax Laws and International Taxation

- Advanced Direct Tax (Income Tax Act, Transfer Pricing, GAAR)

- Tax Planning for Corporates & Individuals

- International Taxation & Double Taxation Avoidance Agreements (DTAA)

- BEPS & OECD Guidelines

- Practical Training: Filing of advanced ITR forms, Transfer Pricing case studies, and exposure to international tax software tools.

Module 8: Indirect Tax Laws (GST & Customs)

- Advanced GST Concepts – Place of Supply, Time of Supply

- Input Tax Credit in Complex Scenarios

- GST on E-commerce & International Trade

- Customs Duty & Valuation

- Practical Training: End-to-end GST compliance with real return filings, reconciliations, and software-driven reporting.

Course Highlights

- Complete ICAI syllabus with practical exposure

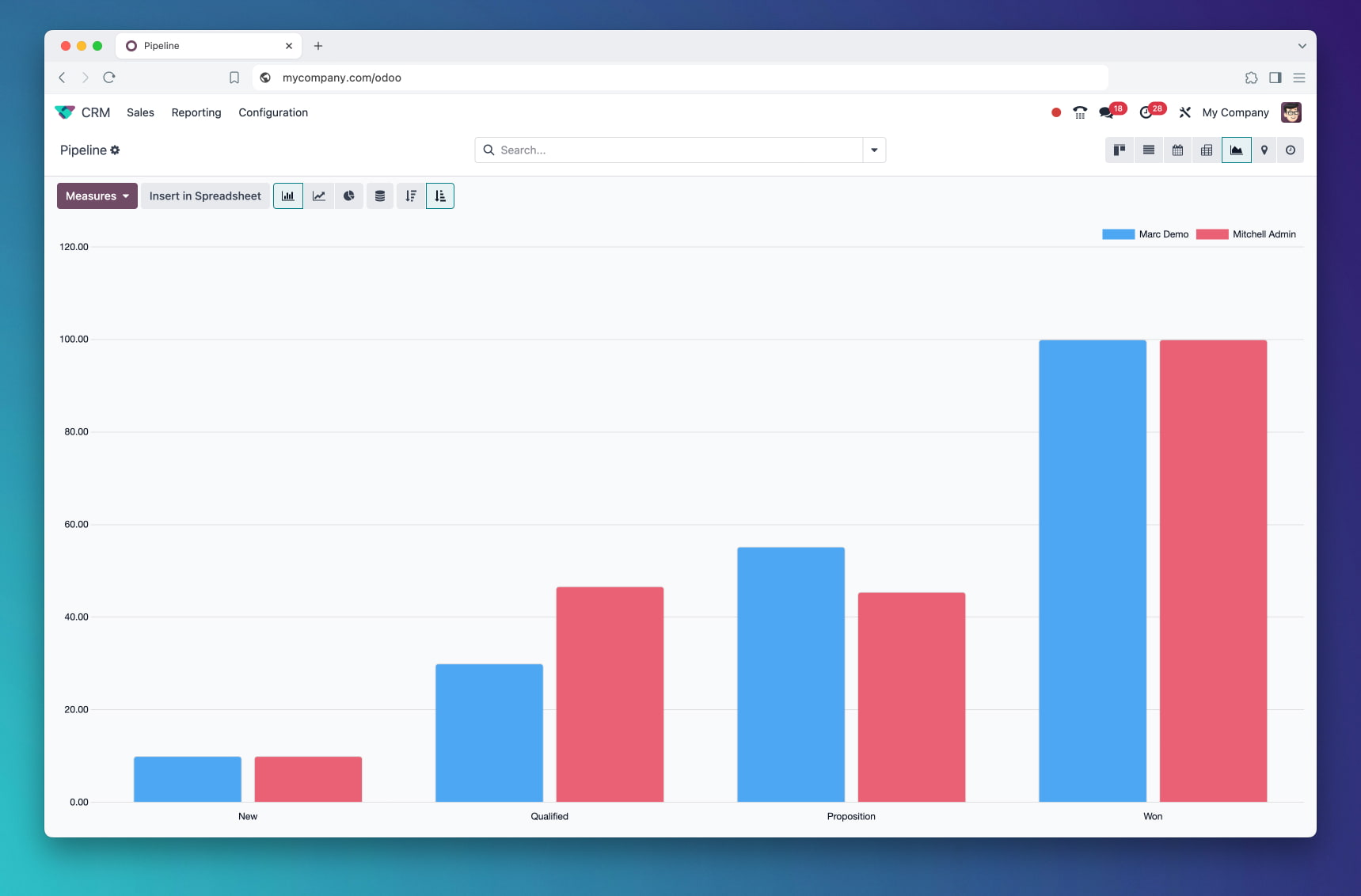

- ERP & Technology Integration – SAP, Oracle, MS Dynamics, Odoo.

- Hands-on Case Studies – Auditing, Taxation & Corporate Finance.

- Mock Exams & ICAI-style assessments.

- Corporate Readiness Training – Ethics, Communication & Leadership.

- Placement Assistance with top CA firms & corporates in India & overseas.

Who Should Join?

- Students who have cleared CA Intermediate (both groups)

- Professionals seeking advanced accounting & finance careers

- Aspirants aiming for roles in Audit, CFO-level finance, Taxation, Consulting, and Global ERP systems.

Why Choose Mercury Edutech Academy?

- Global exposure with ERP-driven practical training

- 45+ years of expertise in Accounting, Audit & ERP solutions

- Industry connections ensuring placement opportunities

- Focus on ethical & professional excellence in line with ICAI values

The CA Final Course at Mercury Edutech Academy doesn’t just prepare you for exams—it prepares you for leadership roles in finance, accounting, and consulting worldwide.

Frequently asked questions

Here are some common questions about our company and services.

CA Final Course: Your Ultimate Guide to the Final Summit

You've navigated the challenging terrains of the Foundation and Intermediate levels. Now, you stand before the final summit: the CA Final examination. This is the ultimate test of your expertise, resilience, and strategic thinking. At Mercury Edutech Academy, we're here to provide the clarity and confidence you need to conquer this final milestone.

Here are the answers to the most crucial questions you might have about the CA Final course.

A. THE BIG PICTURE : UNDERSTANDING THE CA FINAL

The CA Final is the third and final level of the Chartered Accountancy course. It is designed to impart advanced and expert-level knowledge in core financial, legal, and strategic subjects, preparing you to become a qualified Chartered Accountant .

The CA Final tests not just your knowledge but your ability to integrate concepts from multiple subjects to solve complex, real-world business problems. It requires in-depth analysis, expert application, and a high degree of professional skepticism .

The New Scheme has made the Final level more contemporary and practical. The key changes include:

- The number of papers has been reduced from eight to six.

- Elective papers have been removed.

- A new multi-disciplinary paper, Integrated Business Solutions, has been introduced.

- Mandatory Self-Paced Online Modules (SPOMs) have been introduced.

While the Intermediate level focuses on building working knowledge, the Final level aims to build expert and advanced knowledge. The questions are less direct and more focused on case studies, analysis, and practical application derived from your articleship experience .

The

objective is to shape you into a complete business professional, capable of

providing high-quality solutions in auditing, taxation, finance, and corporate

law at a global standard

.

B. ELIGIBILITY,REGISTRATION AND KEY REQUIREMENTS

You can register for the CA Final course after passing both groups of the CA Intermediate examination .

You are eligible to appear for the Final exam after you:

- Complete your two-year practical training (Articleship).

- Complete a six-month study period after your articleship ends.

- Successfully complete the Advanced ICITSS training.

- Qualify the four mandatory Self-Paced Online Modules (SPOMs).

These are mandatory e-learning modules in four specialized areas (Sets A, B, C, D) that you must complete and pass online after clearing your Intermediate exams. They are a prerequisite for appearing in the Final exam .

You will need to secure a minimum of 50% marks in the online examination for each module. You can attempt these exams as many times as needed .

It

stands for Advanced Integrated Course on Information Technology and Soft

Skills. It is a mandatory 4-week training program that you must complete during

the last two years of your practical training, before appearing for the Final

exam

.

The registration is done online through the ICAI's Self-Service Portal (SSP). You need to fill the form and pay the requisite fees after passing your Intermediate exams .

The registration for the CA Final course is valid for ten years .

The registration fee payable to the ICAI is ₹22,000. The examination fee (around ₹3,300 for both groups) is payable separately for each attempt .

C. SYLLABUS AND SUBJECTS (NEW SCHEME)

There are six papers, divided into two groups of three papers each .

- Paper 1: Financial Reporting

- Paper 2: Advanced Financial Management

- Paper 3: Advanced Auditing, Assurance and Professional Ethics.

- Paper 4: Direct Tax Laws & International Taxation

- Paper 5: Indirect Tax Laws

- Paper 6: Integrated Business Solutions (Multi-disciplinary Case Study with Strategic Management).

This is a capstone paper that tests your ability to apply knowledge from all other subjects to solve a comprehensive business case study. It includes concepts from Strategic Management and requires a holistic, integrated approach .

No,

the concept of elective papers (like Risk Management, International Taxation,

etc.) has been removed under the New Scheme. The core papers now

incorporate the most relevant content

.

For subjects like Financial Reporting (Ind AS), Direct & Indirect Tax Laws, and Auditing (Standards on Auditing), staying updated with the latest amendments is not just important—it's absolutely critical. Questions are frequently based on the most recent changes .

D. ARTICLESHIP AND PRACTICAL TRAINING

Your articleship is where theory meets reality. The practical exposure you gain in auditing, taxation, and accounting directly helps you understand and answer the application-based questions in the Final exams .

Yes, during the second year of your articleship, you can opt for Industrial Training in a financial, commercial, or industrial undertaking. It provides excellent corporate exposure .

This is the biggest challenge for Final students. Effective time management is key:

- Utilize weekends and holidays for dedicated study.

- Study for 1-2 hours before or after office hours on weekdays.

- Plan your study leave well in advance .

Both have their pros and cons. Big firms offer specialized exposure and a corporate environment, while mid-sized firms often provide a more diverse, all-around experience. Choose a firm that aligns with your career goals .

E. EXAM STRATEGY AND PREPARATION

- Both Groups: This is highly recommended for rank aspirants and offers the "set-off" benefit. It requires a well-planned and extended study leave.

- Single Group: This is a safer strategy if you have limited study leave or want to ensure a pass by focusing your efforts .

Most students take a dedicated study leave of 4 to 6 months before their exams to focus completely on preparation and revision .

While not mandatory, it is highly recommended. The syllabus is vast and complex. Expert faculty at Mercury Edutech Academy provide structured guidance, simplify complex topics, offer exam-oriented strategies, and conduct mock tests that are crucial for success at this level .

You should aim for a minimum of three complete revisions.

- 1st Revision: For in-depth understanding.

- 2nd Revision: To improve speed and retention.

- 3rd Revision: For a quick brush-up of all important concepts and formulas .

Mock tests are non-negotiable for CA Final preparation. They simulate the exam environment, help you manage the 3-hour time limit, assess your writing speed, and identify your weak areas for improvement .

It's best to stick to one primary source for concepts, preferably the ICAI Study Material, and supplement it with practice manuals, RTPs, MTPs, and your coaching notes. Referring to too many authors can cause confusion .

The ICAI Student's Journal contains important updates and articles. Revision Test Papers (RTPs) are extremely important as they contain fresh questions and all relevant amendments for the upcoming attempt .

Maintain a balanced routine. Take regular breaks, get 7-8 hours of sleep, eat healthy, and practice mindfulness or light exercise. Stay connected with a supportive peer group and mentors .

F. AFTER THE EXAM AND CAREER PROSPECTS

Congratulations! After passing, you must apply to the ICAI for your Membership. Once enrolled, you can officially use the prestigious "CA" prefix .

If you wish to start your own practice and sign financial statements, you must apply for a COP from the ICAI after becoming a member .

The opportunities are vast and rewarding:

- Practice: Start your own firm in Auditing, Taxation, or Consultancy.

- Industry: Join companies in roles like CFO, Finance Manager, or Internal Auditor.

- Banking & Finance: Work in investment banking, portfolio management, or corporate finance.

- Consulting: Join Big 4 firms (Deloitte, PwC, EY, KPMG) or other consulting firms.

- Government Sector & Academics.

The ICAI conducts a campus placement program for newly qualified CAs, where top companies from various sectors come to recruit. It's a fantastic platform to kickstart your career .

The CA Final has a challenging pass percentage. It is perfectly normal to require more than one attempt. Don't lose hope. Analyze your mark sheet, identify where you went wrong, seek guidance from mentors at Mercury Edutech Academy, and reappear with a stronger strategy. Resilience is the key .

Yes, if you score 60 or more marks in any paper, you get an exemption for that paper for the next three attempts .

Yes, the ICAI awards ranks to the top 50 candidates on an All-India basis. Securing a rank is a matter of great prestige.

While it's very demanding, some students pursue courses like CFA or MBA after becoming a CA to specialize further .

CAs are considered "Partners in Nation Building." They ensure financial discipline, promote transparency, and play a vital role in the economic health of the country .

No, your articleship training is a one-time requirement. However, you would need to re-validate your Final registration if it expires after 10 years .

The examiners look for conceptual clarity, application of the correct provisions, and, most importantly, the presentation of your answer. A well-structured answer with proper headings and conclusions fetches more marks .

The pass percentage for the CA Final typically ranges from 10% to 20% per attempt, which underscores the difficulty and prestige of the exam .

You develop a robust set of skills including analytical thinking, problem-solving, time management, professional ethics, and deep technical expertise in finance and law .

Yes, Indian CAs are highly respected globally. The ICAI has MoUs (Memoranda of Understanding) with accounting bodies in several countries (like Canada, Australia, UK), which can facilitate your global career prospects .

Keep your end goal in sight. Break down your preparation into small, achievable targets. Celebrate small successes, and remember why you started this journey .

Building a professional network with peers and seniors during articleship and coaching is invaluable for your future career .

The ICAI provides a "Correction Window" for a limited period after the exam form submission, where you can request a change of center .

While a basic comfort with numbers is required, being a CA is more about analysis, interpretation of law, and logical reasoning than complex mathematics .

Take a well-deserved break, celebrate your incredible achievement with your family and mentors, and then get ready to embark on a brilliant professional career! .