PC3002 - CHARTERED ACCOUNTANCY INTERMEDIATE(CA)

Chartered Accountancy (CA) – Intermediate Course

The CA Intermediate Course is the second level in the Chartered Accountancy journey, designed to build a strong professional base in accounting, auditing, taxation, finance, and corporate laws. At Mercury Edutech Academy, we integrate ICAI’s prescribed syllabus with real-world accounting and ERP software training, so that students not only pass their exams but also gain practical exposure to workplace applications.

COURSE MODULES

GROUP 1

Module 1: Accounting

- Application of Accounting Standards

- Special transactions: Partnership, Companies, Redemption of Debentures

- Accounting for Branches & Departments

- Consolidated Financial Statements

- Accounting in Banking & Insurance Companies

- Practical Training: Preparation of advanced financial statements using Tally Prime, QuickBooks Online, and SAP Business One.

Module 2: Corporate and Other Laws

Part A: Company Law

- Companies Act, 2013 – Key Provisions

- Incorporation, Prospectus, and Share Capital

- Meetings, Directors, and Key Managerial Personnel

- Accounts, Audit, and Dividends

Part B: Other Laws

- Contract Act, 1872

- Negotiable Instruments Act, 1881

- General Clauses Act, 1897

- Interpretation of Statutes

- Practical Training: Drafting resolutions, compliance reports, and corporate communication practices.

Module 3: Cost and Management Accounting

- Costing for Material, Labour, and Overheads

- Cost Accounting Standards

- Marginal & Standard Costing

- Budgetary Control

- Job, Process, and Contract Costing

- Decision Making with Cost Concepts

- Practical Training: Use of Excel, Zoho Books, and ERP costing modules for cost analysis & MIS reports.

Module 4: Taxation

Part A: Income Tax Law

- Basics of Income Tax Act

- Heads of Income (Salary, House Property, PGBP, Capital Gains, Other Sources)

- Deductions, Clubbing, and Set-off Provisions

- Advance Tax & TDS

Part B: Indirect Taxes

- Basics of GST (CGST, SGST, IGST)

- Input Tax Credit & Reverse Charge

- GST Registration & Returns

- Practical Training: Filing of ITRs and GST returns using ClearTax, Tally GST module, and practical return filing exercises.

GROUP II

Module 5: Advanced Accounting

- Accounting Standards (AS & IND-AS applicable at Intermediate level)

- Partnership Accounts (Advanced topics)

- Amalgamation and Reconstruction

- Internal Reconstruction of Companies

- Accounting for Special Entities (Hospitals, NGOs, Co-operatives, etc.)

- Practical Training: Preparing consolidated reports in SAP S/4 HANA and Oracle NetSuite.

Module 6: Auditing and Assurance

- Nature, Objectives, and Scope of Audit

- Audit Documentation and Evidence

- Audit Planning, Risk, and Internal Controls

- Audit of Different Entities (Banks, Insurance, Non-Profit Organizations)

- Company Audit Basics

- Auditor’s Report and Standards on Auditing (SA)

- Practical Training: Drafting audit reports and conducting mock audits using checklists & ERP audit trails.

Module 7: Enterprise Information Systems & Strategic Management

Part A: Enterprise Information Systems (EIS)

- Automated Business Processes

- Information Systems and IT Infrastructure

- Data Analytics & MIS Reporting

- E-Commerce, M-Commerce, and Emerging Technologies

Part B: Strategic Management (SM)

- Business Environment & Strategic Planning

- Leadership and Corporate Governance

- Functional Strategy (Marketing, HR, Operations, Finance)

- Business Policies and Risk Management

- Practical Training: Hands-on ERP exposure with Odoo, SAP, and MS Dynamics 365 for business decision support.

Module 8: Financial Management and Economics for Finance

Part A: Financial Management

- Scope of Financial Management

- Time Value of Money & Capital Budgeting

- Cost of Capital and Capital Structure

- Working Capital Management

- Dividend Decisions & Leverage

Part B: Economics for Finance

- National Income & Public Finance

- Money Market & Capital Market Instruments

- Foreign Exchange Market & International Trade

- Business Cycles and Economic Policies

- Practical Training: Case studies in financial modeling using Excel, Power BI, and ERP financial modules.

Course Highlights

- ICAI-prescribed syllabus with added practical modules

- Hands-on ERP Training (SAP, Oracle, Microsoft Dynamics, Odoo)

- Real Taxation Practice – ITR & GST returns filing sessions

- Mock Audits & Compliance Exercises

- Soft Skills & Corporate Training – Presentation, Interview & Communication Skills

- Mentorship by CAs & Industry Experts

- Placement Support with leading CA firms & corporates

Who Should Join?

- Students who have cleared CA Foundation / CPT

- Graduates seeking a professional accounting qualification

- Candidates aspiring for a career in audit, taxation, financial management, or ERP consulting

Why Choose Mercury Edutech Academy?

- 45+ years of professional expertise in Accounting, Audit & ERP systems

- Balanced approach – theory + practical application

- Strong track record of producing employable, industry-ready professionals

- Globally relevant training with exposure to multiple industries

Ace

Your CA Intermediate Exams: The Ultimate Success Blueprint

Congratulations on clearing the CA Foundation! You've conquered the first peak, and now the exciting challenge of the CA Intermediate awaits. This is where your journey to becoming a Chartered Accountant truly accelerates, and at Mercury Edutech Academy, we're here to be your co-pilot.

The Intermediate level demands more than just hard work; it requires smart, strategic preparation. A well-thought-out plan is the difference between feeling overwhelmed and feeling confident.

This guide is your roadmap. We'll provide you with a proven framework, expert tips, and a clear checklist to help you navigate the CA Intermediate exams successfully.

First, Let's Understand the Battlefield: The CA Inter Exam Structure

Before you plan your attack, you need to know the terrain. The CA Intermediate course is divided into two groups, with a total of six papers. It's crucial to understand the nature of each subject to play to your strengths.

CA Intermediate Subjects at a Glance (New Syllabus)

|

Group |

Paper No. |

Subject |

Nature of Paper |

|

Group I |

Paper 1 |

Advanced Accounting |

Practical-Oriented |

|

Paper 2 |

Corporate and Other Laws |

Theory-Oriented |

|

|

Paper 3 |

Taxation (Direct & Indirect) |

híbrido (Practical & Theory) |

|

|

Group II |

Paper 4 |

Cost and Management Accounting |

Practical-Oriented |

|

Paper 5 |

Auditing and Ethics |

Theory-Oriented |

|

|

Paper 6 |

Financial Mgmt. & Strategic Mgmt. |

híbrido (Practical & Theory) |

Decoding the Question Paper Pattern

A key feature of the CA Intermediate exam is the mix of question types. Understanding this pattern is vital for scoring well.

|

Question Type |

Weightage |

Negative Marking |

Key to Success |

|

Objective (MCQ) |

30% |

No! |

A fantastic opportunity to score full marks. Thorough conceptual clarity is essential. |

|

Descriptive |

70% |

N/A |

Tests your in-depth knowledge, application skills, and presentation. |

Pro-Tip: Since there's no negative marking for MCQs, you should attempt every single one! Mastering the 30 marks from MCQs in each paper can significantly boost your aggregate score.

Your Strategic Blueprint for Success

Success in CA Inter is a marathon, not a sprint. Follow these time-tested steps to build a winning preparation strategy.

Step 1: Master the Syllabus & Create Your Master Plan

Your first task is to thoroughly understand the syllabus for each subject. Break down the entire curriculum into small, manageable modules. Create a realistic, well-structured study schedule that allocates sufficient time to every topic, keeping in mind your personal strengths and weaknesses. A great plan is the foundation of your success.

Step 2: Balance is Key – Practical vs. Theory

Identify which subjects are practical (like Advanced Accounting) and which are theoretical (like Auditing and Laws).

- For Practical Subjects: Consistent practice is non-negotiable. Solve as many problems as you can from the ICAI study material, revision test papers (RTPs), and past exam papers.

- For Theory Subjects: Focus on conceptual understanding, not rote learning. Make your own concise notes, use mnemonic devices, and practice writing answers to improve your presentation.

Step 3: Seek Expert Guidance (Don't Go It Alone!)

The CA Intermediate syllabus is vast and complex. Seeking guidance from experienced faculty can make a world of difference. At Mercury Edutech Academy, our mentors simplify difficult concepts, provide exam-oriented strategies, and offer personalized support to clear your doubts, keeping you on the right track.

Step 4: Practice is Your Superpower

There is no substitute for rigorous practice.

- Mock Tests: Regularly take full-length mock tests under timed conditions. This builds exam temperament, improves time management, and helps you identify areas that need more work.

- Previous Year Papers: Solving past papers gives you invaluable insight into the examiner's mindset and frequently tested topics.

Step 5: Stay Current with Amendments

Subjects like Taxation and Law are dynamic and subject to frequent amendments. Always stay updated with the latest circulars, notifications, and changes announced by the ICAI. This is crucial as questions are often based on the latest amendments.

Step 6: Prioritize Your Physical and Mental Well-being

Your health is your greatest asset during this demanding journey.

- Sleep: Ensure you get 7-8 hours of quality sleep.

- Diet: Eat nutritious food to keep your energy levels high.

- Breaks: Take short, regular breaks during study sessions to avoid burnout.

- Relax: Make time for a hobby or physical activity to de-stress and refresh your mind.

Step 7: Cultivate a Winning Mindset

The CA journey is a test of resilience. Stay positive, celebrate small victories, and learn from your mistakes. Surround yourself with a supportive network of family, friends, and mentors. Believe in yourself and your ability to succeed.

The Final Countdown: Your Pre-Exam Checklist

As your exam date approaches, run through this final checklist to ensure you're fully prepared.

- Syllabus Completion: Aim to finish the entire syllabus at least two months before the exam to leave ample time for revision.

- Mock Tests: Have you taken at least 3-5 full-length mock tests per subject?

- Revision Notes: Are your quick, handwritten notes ready for last-minute revision?

- Time Management: Have you practiced finishing each paper within the 3-hour time limit?

- Important Topics: Have you identified and thoroughly revised the most frequently tested topics?

- Health Check: Are you getting enough sleep and eating well?

- Logistics: Are your admit card, stationery, and exam center location sorted?

Why Walk the Path Alone? Partner with Mercury Edutech Academy

The tips above are the 'what' and 'how' of CA Intermediate preparation. At Mercury Edutech Academy, we provide the 'who'—the expert mentors, structured environment, and proven strategies to turn your hard work into outstanding results.

Your dream of becoming a Chartered Accountant is within reach. Let's achieve it together.

Best of luck!

All

Your Questions Answered!

Frequently asked questions

Here are some common questions about our company and services.

Congratulations on taking the next step in your CA journey! The Intermediate level is where you build the core technical knowledge of a Chartered Accountant. At Mercury Edutech Academy, we've compiled answers to the most common questions to guide you through this crucial stage.

A.

The Basics: Understanding CA Intermediate

The CA Intermediate is the second level of the Chartered Accountancy course. It serves as the bridge between the foundational knowledge you gained in the CA Foundation and the advanced expertise required for the CA Final .

The Intermediate level is significantly more comprehensive and in-depth. While the Foundation tests your aptitude and basics, the Intermediate level provides you with working knowledge of core accounting, finance, and legal subjects. The syllabus is much larger and requires a more strategic approach to study .

The ICAI's New Scheme, effective from July 2023, has streamlined the course. The number of papers has been reduced from eight to six, the syllabus has been updated to be more practical, and the articleship rules have been revised .

There are two groups with three papers in each group, making it a total of six papers.

- Group I: Advanced Accounting, Corporate and Other Laws, Taxation.

- Group II: Cost and Management Accounting, Auditing and Ethics, Financial Management & Strategic Management .

This is a personal strategic decision.

- Both Groups: Offers the benefit of "set-off" (excess marks in one group can compensate for a deficit in the other) and can fast-track your journey. It requires immense dedication.

- Single Group: Allows you to focus

deeply on three subjects at a time, which might be more manageable for

some students.

The primary objective is to equip you with the technical expertise and problem-solving skills needed to function effectively in the accounting and finance industry, preparing you for your practical training (articleship).

B. Eligibility & Registration

There are two routes to enter the CA Intermediate level:

- The Foundation Route: For students who have passed the CA Foundation Examination.

- The Direct Entry Route: For graduates, post-graduates, and students who have cleared the Intermediate level of other professional bodies .

- Commerce Graduates/Post-Graduates: Must have a minimum of 55% marks.

- Non-Commerce Graduates/Post-Graduates: Must have a minimum of 60% marks.

- Students who have passed the Intermediate level of the Institute of Company Secretaries of India (ICSI) or the Institute of Cost Accountants of India (ICMAI) are also eligible .

The entire process is online via the ICAI's Self-Service Portal (SSP). You need to fill out the application form, upload the necessary documents, and pay the registration fee .

You will need an attested copy of your CA Foundation pass mark sheet (for the Foundation route) or your graduate/post-graduate mark sheets (for the Direct Entry route).

You

must complete an eight-month study period after registering for the

course before you are eligible to appear for your first attempt.

- To appear for the May exam, you must register on or before September 1 of the previous year.

- To appear for the November exam, you must register on or before March 1 of the same year .

Under the New Scheme, the registration is valid for five years .

C. Syllabus & Subjects

- Paper 1: Advanced Accounting

- Paper 2: Corporate and Other Laws

- Paper 3: Taxation (Section A:

Direct Tax, Section B: Indirect Tax)

- Paper 4: Cost and Management Accounting

- Paper 5: Auditing and Ethics

- Paper 6: Financial Management & Strategic Management (Section A: FM, Section B: SM).

- Practical-Oriented: Advanced Accounting, Cost and Management Accounting, Financial Management.

- Theory-Oriented: Corporate and Other Laws, Auditing and Ethics, Strategic Management.

- Hybrid (Practical & Theory): Taxation .

It is critically important, especially for papers like Taxation and Law. The ICAI tests students on the latest amendments, and failing to stay updated can result in losing significant marks .

After

successful registration, the ICAI will dispatch the official study materials to

your registered address. They are also available in digital format on the

ICAI's Board of Studies (BoS) portal

.

ICITSS stands for Integrated Course on Information Technology and Soft Skills. It consists of two parts: IT Training and Orientation Course. Yes, completing ICITSS is mandatory before you can commence your articleship .

D. Exam Pattern & Passing Criteria

All six papers follow a 30:70 pattern:

- 30% of the paper consists of Objective type questions (MCQs).

- 70% of the paper consists of Descriptive type questions.

Great news! There is NO negative marking for incorrect MCQ answers in the CA Intermediate exams. This is a huge scoring opportunity .

To pass a single group, you must secure:

- A minimum of 40% marks in each paper of that group, AND

- A minimum of 50% marks in the aggregate of all papers of that group .

The same rule applies: 40% in each paper and 50% in the aggregate for each group. However, you also get the benefit of set-off .

If

you appear for both groups simultaneously and clear one group but fail the

other, the excess marks you scored in the cleared group can be used to cover

the shortfall of marks in the failed group to help you pass

.

If you fail a group but score 60% or more marks in any paper, you are granted an exemption in that paper for the next three attempts. You don't have to appear for that paper again during those attempts .

Each paper is 3 hours long .

E. Articleship (Practical Training )

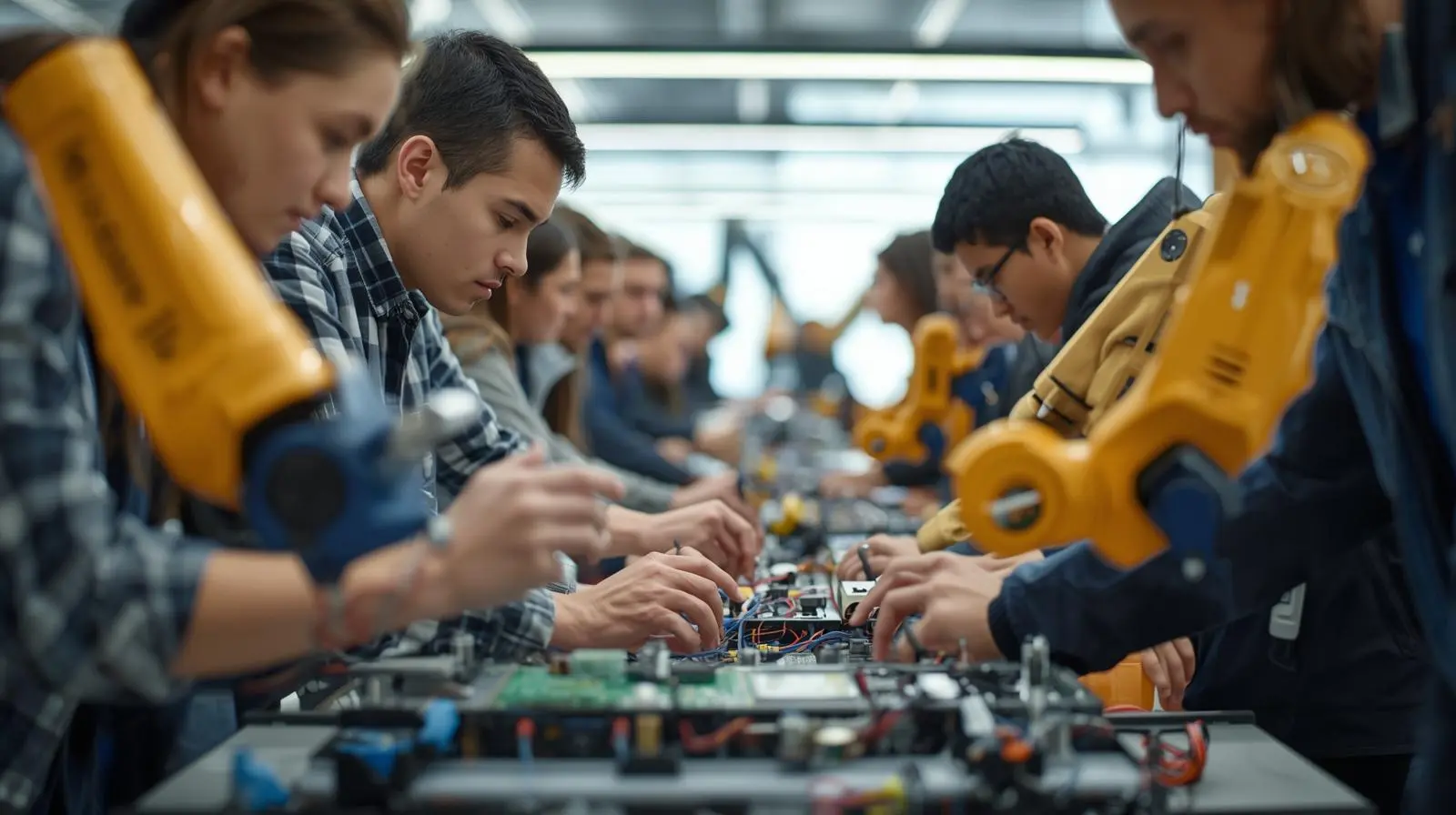

Articleship is a mandatory two-year practical training program where you work under a practicing Chartered Accountant. It is the cornerstone of the CA course, providing you with invaluable hands-on experience.

You can start your articleship only after you have passed both groups of the CA Intermediate examination and completed the mandatory ICITSS training.

You will get exposure to various domains like Auditing & Assurance, Direct and Indirect Taxation, Accounting, Corporate Law, and Financial Management.

Yes, you are paid a minimum monthly amount called a stipend, which is prescribed by the ICAI. The actual amount can vary depending on the firm and the city.

You

can look for vacancies on the ICAI's articleship portal, through professional

networking sites like LinkedIn, or by directly applying to CA firms in your

city

.

F. Preparation Strategy

While the mandatory study period is eight months, a dedicated preparation of 9-10 months is ideal to cover the vast syllabus, revise multiple times, and solve mock test papers .

This depends on your learning style. However, given the complexity and vastness of the syllabus, joining a reputed institute like Mercury Edutech Academy provides structured guidance, expert mentorship, and a disciplined study environment that greatly enhances your chances of success .

Focus on conceptual clarity. Make your own notes, use keywords and charts, and practice writing answers. Regular revision is the key to retaining information in theory subjects .

Start by understanding the concepts and then solve as many problems as you can. Begin with the ICAI study material and then move on to Revision Test Papers (RTPs), Mock Test Papers (MTPs), and past exam papers.

They

are extremely important. They give you an idea of the expected exam

pattern, the type of questions asked, and help you assess your preparation

level just before the exams

.

Ideally,

you should aim for at least three complete revisions to be confident and

well-prepared for the exams

.

G. After the Exam and Next steps

Results are typically announced by the ICAI approximately two months after the exams conclude .

You can start preparing for the second group for the next attempt. Your passed group is valid, and you don't need to appear for it again .

Don't be discouraged! The CA course is a test of perseverance. Analyze your mistakes, re-strategize your study plan, and prepare for the next attempt with renewed focus. Your registration is valid for 5 years, giving you ample opportunities .

Congratulations! After passing both groups, you need to:

- Complete your ICITSS training.

- Register for and commence your two-year practical training (Articleship).

- Register for the CA Final course .

Yes,

absolutely. Many students pursue their B.Com degree alongside their CA

preparations, as the syllabus has a significant overlap, making it manageable

.

After

clearing Intermediate, you must start your articleship. The CA Final exam can

only be attempted after completing your practical training and an additional

six-month study period

.

Under

the New Scheme, after passing the Intermediate exams and before appearing for

the Final exam, you must clear four Self-Paced Online Modules in subjects like

Economics Law and Strategic Cost Management

.

Your

registration is valid for five years, within which you can make up to 10

attempts without re-registering

.

Yes,

the ICAI releases an All India Merit List for the top 50 rank holders in the CA

Intermediate exams

.

Yes,

the ICAI provides a process for students registered under the old syllabus to

convert to the New Scheme of Education and Training

.

Yes, during the last part of your articleship,

you may opt for industrial training in a company from the financial or

commercial sector for a specified period

.

This

is an advanced version of the ICITSS, which you need to complete after your

articleship and before appearing for the CA Final exam

.

At Mercury

Edutech Academy, we provide expert faculty, a comprehensive and

exam-oriented study plan, regular mock tests, personalized doubt-solving

sessions, and a motivating environment to guide you at every step of your CA

Intermediate journey, ensuring you are not just prepared, but exam-ready

.